Amidst fervent discussions within the U.S. industry, one burning question dominates the discourse: Will the Georgia House of Representatives greenlight a constitutional amendment to put the legalization of sports betting to a public vote? This pivotal query weighs heavily on the minds of stakeholders across the betting landscape, from industry magnates to avid punters.

In a succinct response from IGB analysts: the outlook appears dim.

However, the nuanced reality unveils a tale of fiscal urgency marred by legislative gridlock. Despite the state's pressing financial needs, lawmakers find themselves mired in a quagmire of indecision. Tensions reached a crescendo during a recent House Higher Education Committee hearing on SR 579, culminating in acrimonious debates and unfounded allegations, including mentions of heroin. Additionally, officials disseminated misinformation about the gambling sector, exacerbating the impasse.

Notably, concerns were raised regarding the state's substantial $16 billion budget surplus, yet the exploration of alternative revenue streams remains sluggish. Moreover, the revelation that at least one lawmaker conflated New York with New England highlights a glaring deficiency in geographic literacy among those tasked with shaping pivotal policies. Such lapses underscore the gravity of entrusting legislative decisions to individuals lacking a fundamental understanding of their own country's geography.

Impasse Looms as Compromise Eludes Lawmakers on Sports Betting Legalization

With the clock ticking and the legislative session looming, the prospect of legalizing sports betting in Georgia hangs in limbo. Despite four years of fervent efforts, lawmakers find themselves at an impasse, unable to forge a consensus on the creation of an online betting marketplace.

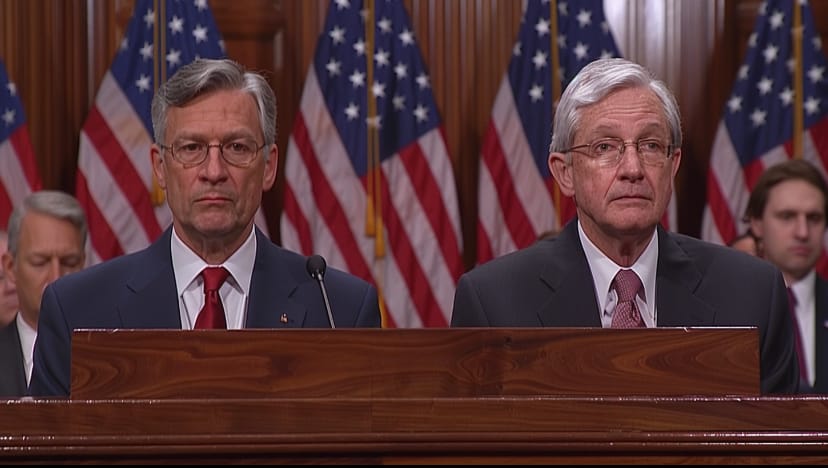

The latest bill presented by Senator Bill Cousert offers a potential pathway to legalization, positioning it as a constitutional amendment to permit another form of gambling akin to the lottery. However, the path to legalization proves far from straightforward, with contentious debates surrounding the allocation of gambling tax revenue and the regulatory framework.

Central to Cousert's proposal is the establishment of a new gambling commission, alongside robust funding for initiatives aimed at addressing gambling-related issues and promoting responsible gambling practices. Expressing dissatisfaction with existing measures, Cousert underscores the need for more effective interventions to combat gambling problems.

Echoing Cousert's concerns, witnesses implore the committee to exercise caution, citing the potential societal repercussions of legalizing betting. Drawing a poignant analogy, Mike Griffin, representing the Georgia Baptist Mission Board, invokes the biblical narrative of Pontius Pilate and the crowd's cry for crucifixion. In essence, he underscores the weight of responsibility resting on the shoulders of the state's residents in determining the fate of sports betting legalization.

As the debate rages on, time dwindles, leaving lawmakers with a crucial decision to make before the legislative session commences. The stakes are high, and the outcome remains uncertain as Georgia grapples with the complexities of gambling legislation.

Clarifying Misconceptions Surrounding Sports Betting Revenue

Throughout the hearing, it became apparent that committee members lacked a comprehensive understanding of the mechanics of sports betting, including its financial implications and regulatory intricacies. As discussions unfolded, Senator Cousert found himself elucidating fundamental concepts, such as the distinction between betting income and tax revenue, and the nuances of tax allocation.

Amidst deliberations on potential tax revenue from sports betting, Senator Cousert clarified that projected figures often refer to the total amount wagered, rather than the net operator revenue or tax revenue. This distinction is crucial in determining the actual funds available for allocation to problem gambling (PG) and responsible gambling (RG) programs.

The proposal to dedicate 15% of tax revenue to PG and RG initiatives sparked debate, with concerns raised about the perceived surplus if revenue projections were exceeded. However, it was underscored that such projections are contingent on various factors, including the tax rate, withholding percentage, and deductibility of promotions.

Contrary to misconceptions, the proposed allocation for PG and RG programs far exceeds the national average, indicating a proactive approach to addressing gambling-related issues. Nonetheless, the lack of understanding among legislatorshighlights a concerning disinterest in the nuances of sports betting legalization and revenue generation.

While Senator Cousert has demonstrated a commitment to the democratic process and willingness to negotiate, his apparent ignorance on certain aspects underscores the need for informed discourse. Misstatements regarding tax rates in other states, coupled with geographical inaccuracies, further underscore the need for comprehensive education on the subject.

As discussions continue, it is imperative for lawmakers to foster a deeper understanding of sports betting dynamics and potential revenue streams. With SB 386 awaiting further deliberation and potential amendments, the Higher Education Committee's forthcoming meetings will undoubtedly play a pivotal role in shaping the future of sports betting legalization in Georgia.