The beginning of the year brought an insightful analysis from IGB on betting syndicates, with Tom Waterhouse of Waterhouse VC discussing the highs and lows of 2023 in the betting industry.

Despite an overall increase in the value of betting companies in 2023, significant variations were observed across different regions and sectors. With global interest rates rising, investors have become more selective, favoring investments in exclusively profitable companies.

Two major contributors to the fund's impressive +39.5% result in 2023 were:

• Project Tennis – a professional tennis betting syndicate founded by Tom Dry, initially discussed in December 2022 and invested in by July 2023.

• Saintly – an operator in the crypto wagering and B2B platform sector.

A Year of Triumphs

Project Tennis, led by Tom Dry, has been a standout operational success. The fund is well on its way to recouping its entire investment in the syndicate by January 2025, just 18 months post-investment.

Expanding beyond tennis, Waterhouse VC is exploring professional betting opportunities in horse racing, a sector intriguing for its tote rebates. Large syndicates benefit from these rebates due to their liquidity contributions, offering a significant edge over other bettors.

Saintly's Seven-Month Success Story

Saintly was the single largest contributor to the fund's 2023 performance. In February 2023, Waterhouse VC negotiated an option to acquire 20% of Saintly, drawn by its digital platform well-positioned to capitalize on the burgeoning crypto wagering opportunity first identified in May 2022.

Emerging Markets: India and Brazil

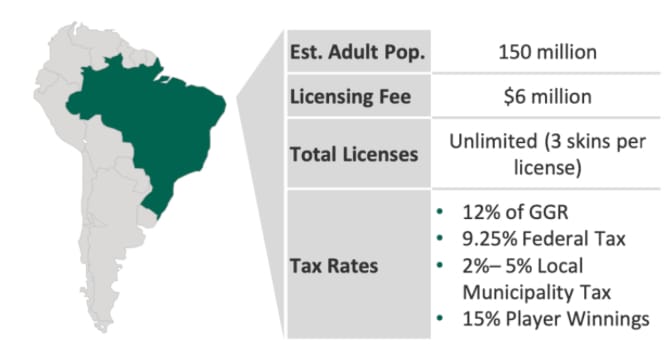

Looking ahead to 2024, Brazil and India emerge as key growth regions for operators and B2B suppliers. The online wagering industry in India, growing at over 20% annually, is buoyed by the country's rapid economic progress.

In contrast, Brazil is poised for a boom in online wagering following the official approval from President Lula da Silva, with 134 operators ready for the newly regulated industry.

2024 Projections

Waterhouse VC is particularly keen on professional betting, emerging markets like Brazil and India, and B2B suppliers offering unique services to the gaming and wagering sector. The fund offers wholesale investors exclusive access to attractive investment opportunities in these areas.

As a key investor in both publicly-listed and private small-scale companies linked to gambling and betting, Waterhouse VC achieved a remarkable +39.5% return in 2023, outperforming major indices like S&P500 and ASX200.